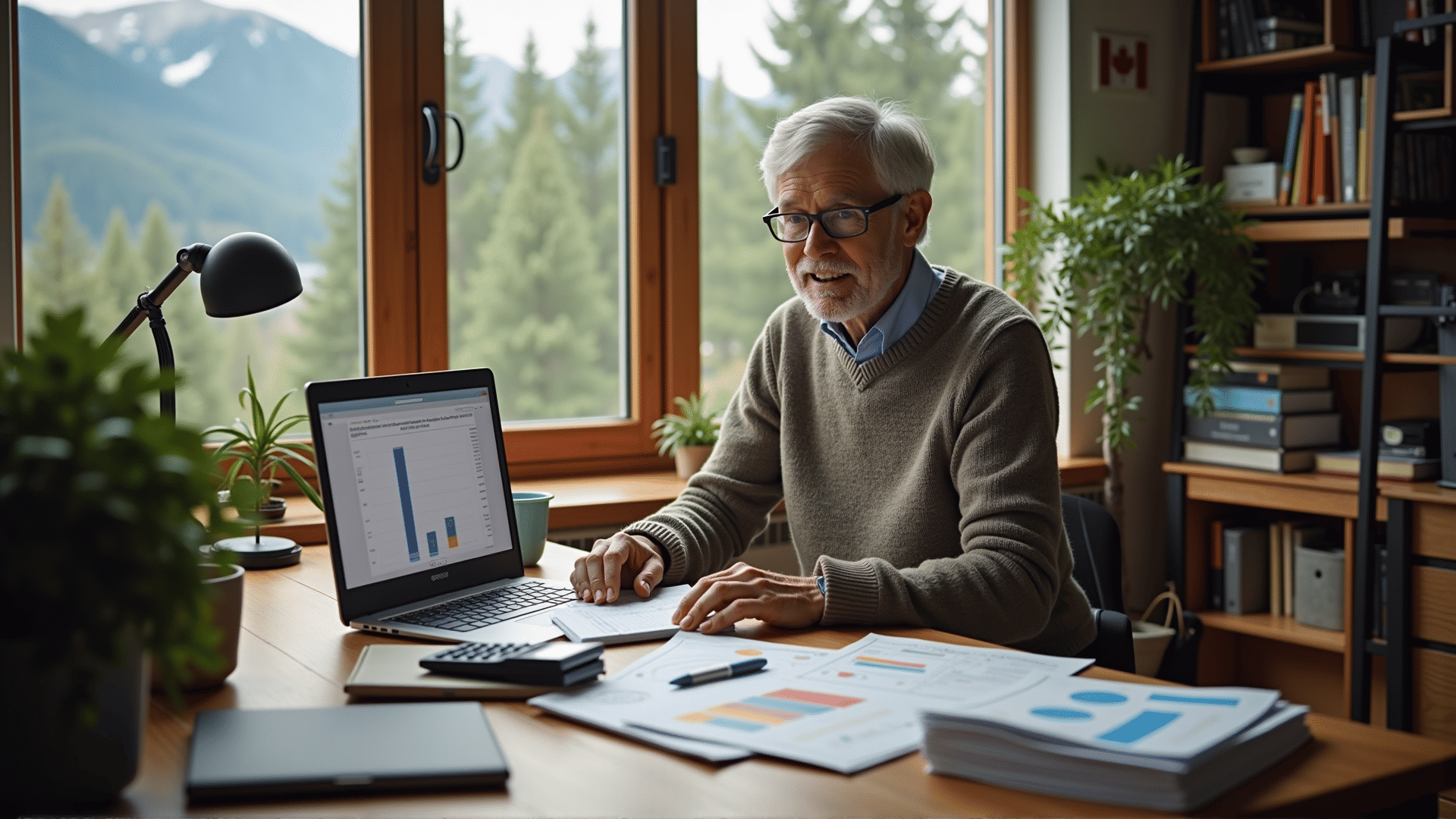

Empowering Canadians through Education

Understanding Financial Literacy

Profinear, committed to improving financial literacy across Canada, presents educational content that empowers individuals to build sustainable money-management skills. Our non-commercial approach emphasizes knowledge over transactions, focusing on nurturing informed financial behaviors among Canadians.